The market is buzzing about Apple (AAPL), and rightfully so. The stock closed today at $273.76, up a significant 13.17%. But beneath the headlines proclaiming AI breakthroughs and China iPhone recoveries, lies a more profound narrative: Apple’s continued dominance rests not just on innovation, but on an almost unparalleled consumer loyalty and a carefully cultivated ecosystem. Is the current surge justified, or is it a fleeting moment of market exuberance? Let’s delve deeper.

The Lede: Riding the Wave of Optimism

Apple’s recent performance is fueled by a confluence of positive catalysts. JPMorgan’s report signaling demand-supply parity for the iPhone 17 is a significant confidence booster, addressing previous concerns about production bottlenecks. The legal win regarding the Apple Watch also removes a potential overhang. Simultaneously, Wall Street analysts, notably Morgan Stanley, are increasing their price targets, citing Apple’s pricing power and anticipated gains from its AI initiatives. The stock is trading near $274, painting a picture of a company regaining its footing after a period of uncertainty. However, the crucial question remains: are these short-term victories enough to sustain long-term growth, especially amidst increasing competition and regulatory pressures?

Deep Dive: The Apple Ecosystem – More Than Just Products

To truly understand Apple’s appeal, one needs to appreciate the power of its ecosystem. Think of it as a meticulously crafted garden, where each plant (device, service, software) is carefully nurtured and designed to thrive in harmony with the others. This seamless integration creates a user experience that is both intuitive and compelling, making it difficult for customers to switch to rival platforms. While other companies offer individual products that may be superior in certain aspects, none can replicate the holistic experience that Apple provides.

The success of the iPhone, for example, is not solely attributable to its hardware features. It’s the combination of the iOS operating system, the App Store, iCloud, Apple Music, and other services that locks users into the Apple ecosystem. This “walled garden” strategy ensures recurring revenue streams and fosters brand loyalty. Competitors can offer cheaper phones or more powerful processors, but they struggle to match the overall experience that Apple delivers.

The recent focus on AI further strengthens this ecosystem. Apple’s newly released AI model, while not yet fully understood in terms of its capabilities, represents a strategic move to enhance its offerings across various product lines. Unlike companies hyping AI for the sake of hype, Apple integrates it thoughtfully. Consider, for example, the potential for AI-powered enhancements to Siri, Photos, or even the Apple Watch’s health features. These improvements not only add value to existing products but also create new opportunities for innovation and differentiation. The AI model release is not just about technology; it’s about making the ecosystem sticky.

However, Apple’s ecosystem is not without its challenges. Regulatory pressures concerning the App Store and potential antitrust scrutiny pose a threat to its business model. The company must navigate these challenges carefully to maintain its competitive edge. This is especially true regarding regulatory pressure and debate concerning the App store. Relevant App Store Regulatory News

The situation in China is another key factor. Reports of improving iPhone demand in China are encouraging, but the company faces intense competition from domestic brands like Huawei and Xiaomi. Success in China is crucial for Apple’s long-term growth, and it must continue to innovate and adapt to the evolving needs of Chinese consumers. The fluctuating demand in China will be something to watch closely.

The foldable phone, as speculated by Seeking Alpha, may be a path to reignite growth in the hardware space, proving that the future may hold hardware innovation despite the recent AI releases.

Wall St. Verdict: Cautious Optimism Prevails

Wall Street analysts generally view Apple favorably, but with a degree of caution. Morgan Stanley’s increased price target reflects confidence in the company’s pricing power and AI prospects. JPMorgan’s report on iPhone 17 demand-supply parity is another positive signal. However, some analysts remain concerned about regulatory risks and competition in key markets like China.

Jim Cramer’s observation that Apple maintains high consumer product satisfaction is particularly noteworthy. This underscores the importance of brand loyalty and the strength of the Apple ecosystem. Even in the face of competition, Apple continues to command a premium price, reflecting the perceived value of its products and services.

Institutional investment activity, as reported by Benzinga and MarketBeat, paints a mixed picture. Some firms, like WestHill Financial Advisors Inc., have trimmed their positions, while others, like SK Wealth Management LLC, have increased their holdings. This suggests that institutional investors have varying perspectives on Apple’s future prospects. The activity of Whales will be an important factor moving into the new year. Relevant Whale Activity News

The Technicals: Key Levels to Watch

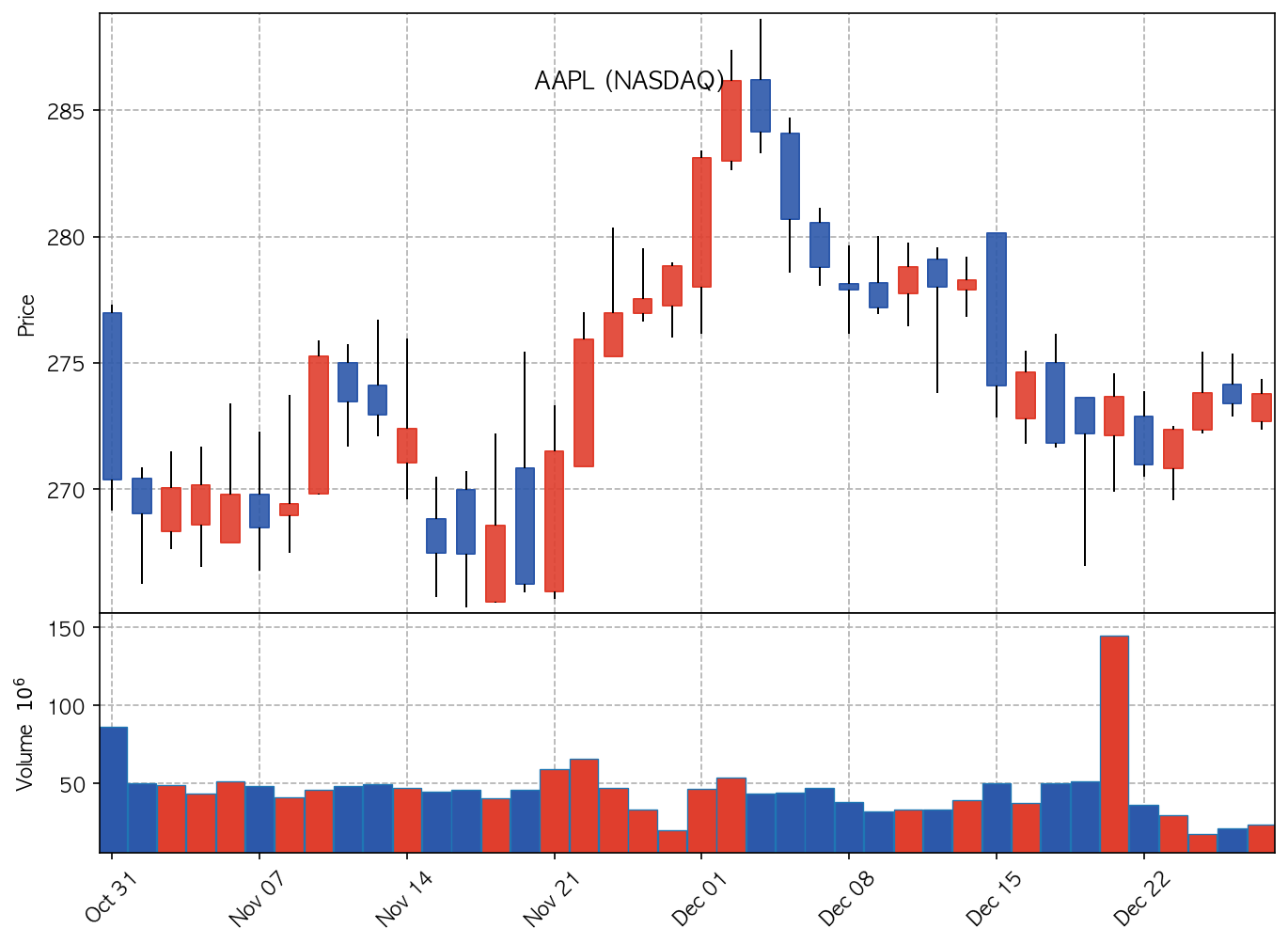

From a technical perspective, Apple’s recent price surge has pushed it above several key resistance levels. The stock is currently trading near $274, and a breakout above this level could pave the way for further gains. Key support levels to watch include $260 and $250. A break below these levels could signal a potential correction. Investors should also monitor the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators for signs of overbought or oversold conditions. These are all key factors when determining if the stock price will continue to rally or consolidate.

Conclusion: The Endurance of Brand and the AI Wildcard

Apple’s recent performance is a testament to the enduring power of its brand and the strength of its ecosystem. While the company faces challenges, its ability to innovate and adapt has consistently allowed it to overcome obstacles. The focus on AI represents a strategic opportunity to enhance its existing products and services, but it also carries risks.

Investors should carefully consider both the opportunities and the challenges before making any investment decisions. While the current market sentiment is positive, it is essential to remain grounded in reality. Apple’s future success hinges on its ability to execute its AI strategy effectively, navigate regulatory pressures, and maintain its competitive edge in key markets like China. The recent news certainly is something to be excited about, but the AI space is still speculative, and no one can say with certainty the true value of the latest AI model release.

Ultimately, Apple’s greatest strength lies in its loyal customer base. As long as the company continues to deliver innovative products and services that meet the needs of its users, it is likely to remain a dominant force in the technology industry for years to come. However, investors should not get caught up in the hype and should carefully evaluate the company’s fundamentals before making any investment decisions.

🔗 Useful Resources

Disclaimer: This content is for informational purposes only. Investment involves risk. Not financial advice.