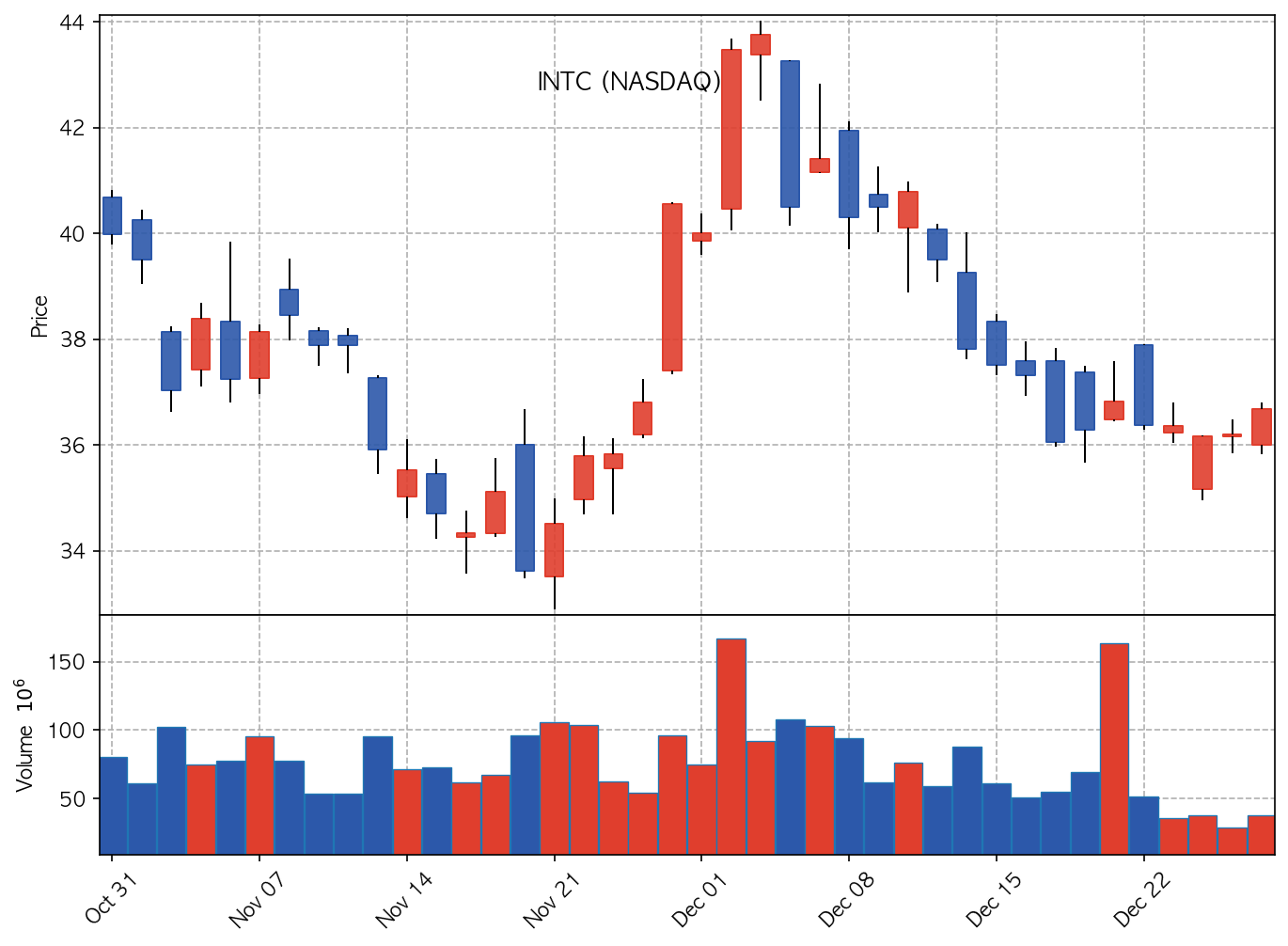

▲ INTC Daily Candle Chart

📊 Market Data Analysis

| Metric | Value |

|---|---|

| Price | 36.68 |

| Change | 1.33% |

🧐 In-Depth Analysis: The Catalyst

Intel (INTC) finds itself at a crucial juncture. The recent news flow paints a picture of both opportunity and challenges. The emerging plans for Fab 52, Nvidia’s investment, and ongoing analyst target evaluations all contribute to the current market sentiment. However, the backing out of a full commitment to Intel’s 18A chip deal by Nvidia casts a shadow, necessitating a nuanced understanding of the situation.

Key Insight 1: Foundry Execution is Paramount. Intel’s ambitious foundry strategy, centered around processes like 18A, is critical to its long-term success. The initial enthusiasm surrounding Nvidia’s potential use of 18A provided a significant boost to investor confidence. Nvidia’s reduced commitment, while not a complete abandonment, introduces a layer of uncertainty. Intel must demonstrate its ability to execute flawlessly on its foundry roadmap to attract and retain major clients.

Key Insight 2: AI Partnerships are Vital. The semiconductor industry is increasingly driven by AI. Intel’s success hinges on its ability to forge strong partnerships in the AI space. The company must not only manufacture chips but also develop and optimize its offerings for AI applications. The narrative around AI partnerships and associated revenue will be a key determinant of Intel’s stock performance in the coming quarters. The market closely watches signals such as Nvidia’s $5 billion purchase of Intel shares and its implications for future cooperation.

Key Insight 3: 2026 Analyst Targets Remain a Key Benchmark. Various analyst targets, particularly those extending into 2026, will serve as critical benchmarks for investors. These targets reflect expectations regarding Intel’s turnaround progress and its ability to compete effectively in the evolving semiconductor landscape. Any significant deviations from these targets, whether positive or negative, will likely trigger substantial market reactions.

The reports of Cwm LLC increasing its stake in Intel signal confidence from some institutional investors. However, it’s crucial to remember that a single investor’s actions do not define the overall investment thesis.

🗣️ Institutional & Expert Voices

The general Wall Street consensus regarding the semiconductor industry is one of cautious optimism. While acknowledging the cyclical nature of the business, analysts recognize the long-term growth potential driven by secular trends such as AI, cloud computing, and the Internet of Things. Morgan Stanley, in their recent sector report, emphasized the importance of companies demonstrating both technological innovation and manufacturing prowess. They highlight that while demand remains robust, execution risk is elevated, particularly for companies undergoing significant strategic shifts, such as Intel with its foundry initiative.

🔮 Technical Outlook & Strategy

From a technical perspective, Intel’s stock price is currently hovering around a critical level. Immediate support can be found near the $35.50 level, while resistance lies around $38. A decisive break above $38 could signal a bullish continuation, potentially leading to a test of the $40 level. Conversely, a break below $35.50 could trigger a deeper correction.

Bullish Scenario: If Intel can successfully demonstrate progress on its foundry execution, secure key AI partnerships, and maintain positive momentum towards its 2026 targets, the stock could experience a significant upward trajectory. A sustained break above $38, accompanied by strong volume, would be a strong indication of a bullish breakout. In this scenario, accumulating shares on pullbacks towards the $36 level could be a viable strategy.

Bearish Scenario: Further setbacks in foundry execution, the loss of key partnerships, or a downward revision of analyst targets could negatively impact the stock. If the stock breaks below the $35.50 support level, a short-term bearish trend could emerge. Investors should exercise caution and consider reducing their exposure if these negative catalysts materialize.

📝 Final Verdict

Based on the current landscape, a Hold rating is warranted for INTC. The company’s turnaround strategy holds significant potential, but it is not without its risks. The uncertainties surrounding foundry execution and the evolving dynamics of the AI market necessitate a cautious approach. Investors should closely monitor Intel’s progress on its key initiatives and be prepared to adjust their positions based on new developments. While the recent price appreciation is encouraging, the road to sustained recovery is likely to be volatile.

🔗 Reference Links (Yahoo Finance)

👉 Check Real-time Quotes for INTC

Disclaimer: This content is for informational purposes only (주식 정보 공유 목적). Investment decisions are the sole responsibility of the investor (투자의 책임은 투자자 본인에게 있습니다).