📉 GOOGL Technical Analysis

[2025-12-30] Google’s AI Gamble Pays Off: Next Stop, $400 or Catastrophe?

Subheadline: Alphabet’s aggressive AI investments, particularly Gemini and the rumored Intersect acquisition, are poised to launch GOOGL into a new valuation stratosphere. But can they maintain their lead against fierce competition, or is this the peak before a brutal correction?

The Lede: Forget boring earnings reports and incremental growth. Google’s morphing into something *completely* different. They’re not just a search engine anymore; they’re building an AI empire, and the market’s finally waking up. Are you ready to ride the rocket…or get left behind in the silicon dust?

Market Context: GOOGL is surging not because of search (that’s old news!), but because of the perceived lead in the AI race. The narrative has shifted from a mature tech giant to a disruptive AI innovator, fueled by optimistic analyst forecasts projecting a 23% price jump in 2026 and whispers of a 25% market share grab for its AI chips. The market *loves* this story right now, and this love affair is directly translating into bullish price action. Throw in the strategic acquisition of Intersect (if the rumors are true!) to bolster their AI footprint, and you have a recipe for explosive growth. However, recent trimming of GOOGL holdings by certain firms suggests a potential cooling-off period as the market digests these rapid changes. And make no mistake. The AI space is crowded! Competitors are hungry and we must watch for changes in the marketplace.

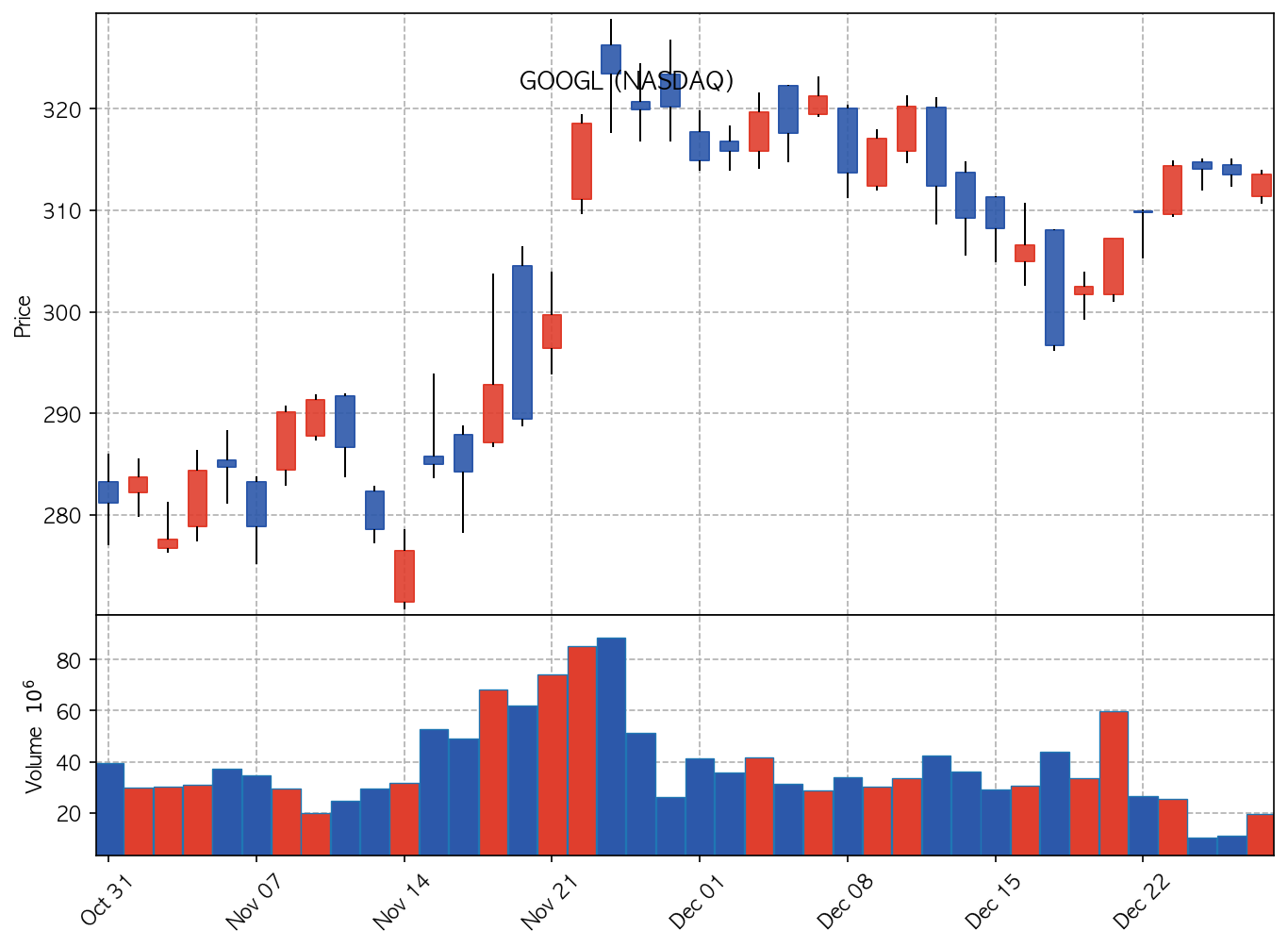

Technical Analysis: We’re currently sitting at $313.56, a healthy 1.59% gain today alone! The stock’s been on a tear, shattering resistance levels like a wrecking ball through a sandcastle. Key support now lies around $300, a level we *need* to hold. If we break that, look out below! Immediate resistance sits at $320. A sustained break above that confirms the bullish momentum. The RSI is flirting with overbought territory, so a pullback is possible, even healthy. MACD remains strongly bullish, indicating that the upward trend still has legs. Keep a close eye on volume; declining volume on this rally could signal a potential top.

The Verdict: GOOGL is a BUY…*with a HUGE asterisk*. The AI narrative is real, and Google’s position is undeniably strong. The Intersect acquisition could be a game-changer. However, this rally is built on hype and speculation. The price is approaching rich valuations, reflecting expectations for enormous AI chip adoption. This creates downside risk. If you’re already in, consider trimming your position to lock in profits. If you’re on the sidelines, wait for a pullback to the $300-305 range before initiating a position. This isn’t a set-it-and-forget-it stock; this requires active management. Prepare for volatility, keep a close eye on the news flow, and get ready to pull the trigger if the narrative shifts. This isn’t just about buying a stock; it’s about betting on the future of AI… and Google’s ability to dominate it. Don’t bet the farm!

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.