📉 META Technical Analysis

[2025-12-30] Meta’s Rollercoaster ENDS? AI Pivot Could Save (Or Sink!) The Empire – My $658.69 Call

Subheadline: Despite a brutal year and a stock price resembling a ski slope, Meta’s aggressive AI acquisitions, particularly Manus, and a potential revenue stream in charging business pages for links, offers a high-risk, high-reward scenario. Zuckerberg’s doubling down on AI and hardware is either visionary or another metaverse-sized money pit. The next 12 months will be the judge.

The Lede: Forget the metaverse, folks! Wipe away the Horizon dust! Mark Zuckerberg’s playing a new game, and the stakes are higher than ever. After a catastrophic year that saw META shed nearly 70% of its value, Wall Street is whispering the unthinkable: is this the beginning of the end? But amidst the ashes of shattered dreams and billions incinerated, a flicker of hope remains: AI. But is hope enough to justify $658.69 per share? Or will AI acquisition just make META the biggest robot in the room?

: META, 1-Year Performance, Comparing Performance to S&P500 and NASDAQ)

Market Context: The tech landscape in 2025 is Darwinian. AI is king, and Meta’s late-but-furious scramble to acquire AI talent and build an ecosystem around it is the only thing keeping the vultures at bay. The market is reacting nervously. Concerns about long-term profitability and the abandonment of the 3rd Party Horizon OS Headsets shows just how fickle META can be. Furthermore, news like NY requiring TikTok and Meta to display mental health warnings, show that there are still social forces looking to reduce the power of these social platforms. The market loves AI, but it also hates being burned. Zuckerberg has to prove this isn’t just another shiny object. The “Magnificent Seven” moniker alone isn’t enough to save META.

onto a table against a backdrop of burning money (labeled Metaverse).)

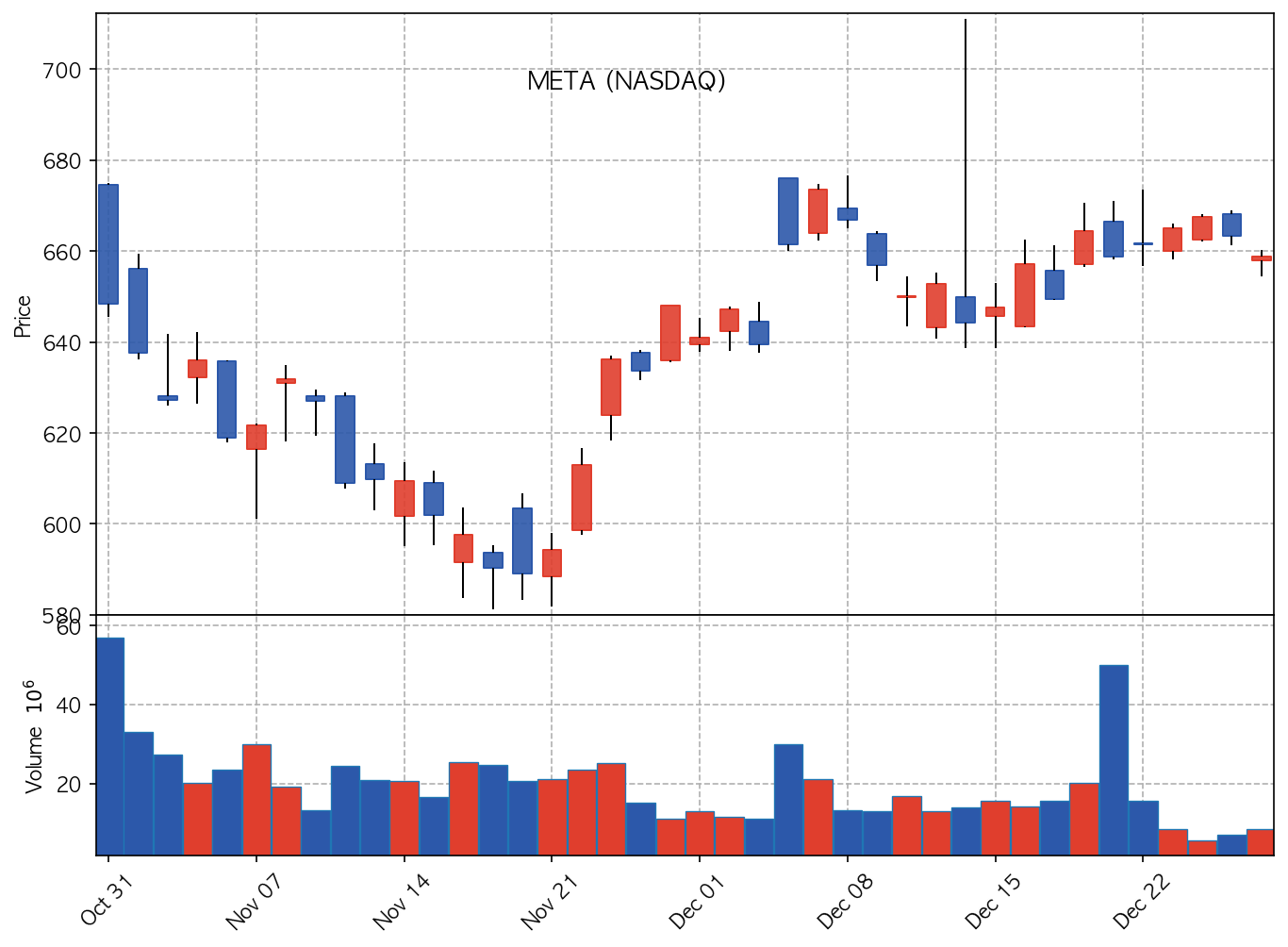

Technical Analysis: The bleeding may not be over. We saw a brief dead cat bounce from the Manus acquisition news, but the overall trend is still firmly downward. Support levels are weak, and resistance is fierce. Look for a potential test of $600 if positive momentum doesn’t emerge quickly. A break below $600 could trigger a waterfall effect. On the upside, META needs to decisively break $700 and hold it before we can even begin to talk about a genuine recovery. The 50-day moving average is currently acting as a major roadblock. Any positive signal will be reliant on a strong earnings report showing demonstrable AI-driven revenue. Until then, tread cautiously.

The Verdict: Buckle up, buttercups. This is a HIGH-RISK, HIGH-REWARD situation. I’m *cautiously* maintaining a HOLD rating. Zuckerberg is a survivor, and the AI pivot *could* be a masterstroke. The Manus acquisition is interesting. Charging business pages could be a source of incremental revenue (or it could accelerate user churn). BUT, I’m not recommending you pile in at $658.69. Watch for verifiable progress in AI monetization and a sustained break above $700. If those conditions aren’t met, prepare for further downside. Consider it a speculative hold ONLY if you have the stomach for volatility and understand the inherent risks. Otherwise, stay on the sidelines and watch the show. META’s story is far from over, but the next chapter will determine its destiny.

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.