📉 MSFT Technical Analysis

[2025-12-30] Microsoft’s About To Crack! Is This Your Last Chance to BUY (Or Sell Everything)?!

Subheadline: MSFT plummets! AI optimism clashes with profit reality. Is this a temporary dip or the beginning of a devastating correction? Our deep dive reveals the truth.

The Lede: Forget the eggnog and holiday cheer! Microsoft’s stock is hemorrhaging, down a staggering 12.51% today. The whispers of an unstoppable AI juggernaut are now drowned out by the screams of panicked investors. Is the AI spending about to finally show whether its worth it or lead to an overspending collapse.

Market Context: The “Santa Rally” evaporated faster than free cookies at a Christmas party. Several factors are converging to hammer MSFT. Firstly, the market is re-evaluating AI spending. The initial euphoria is giving way to scrutiny of actual ROI. While “Gaming Copilot” may be “genuinely useful,” investors are questioning if it justifies the massive capital expenditure. Secondly, the Fed minutes loom large, and any hint of continued hawkishness will further pressure tech stocks. Fortitude Financial’s reduced position is also a worrying signal, suggesting institutional skepticism. Finally, despite the overwhelmingly positive longer-term outlook from analysts like Dan Ives, short-term anxieties are dominating the narrative.

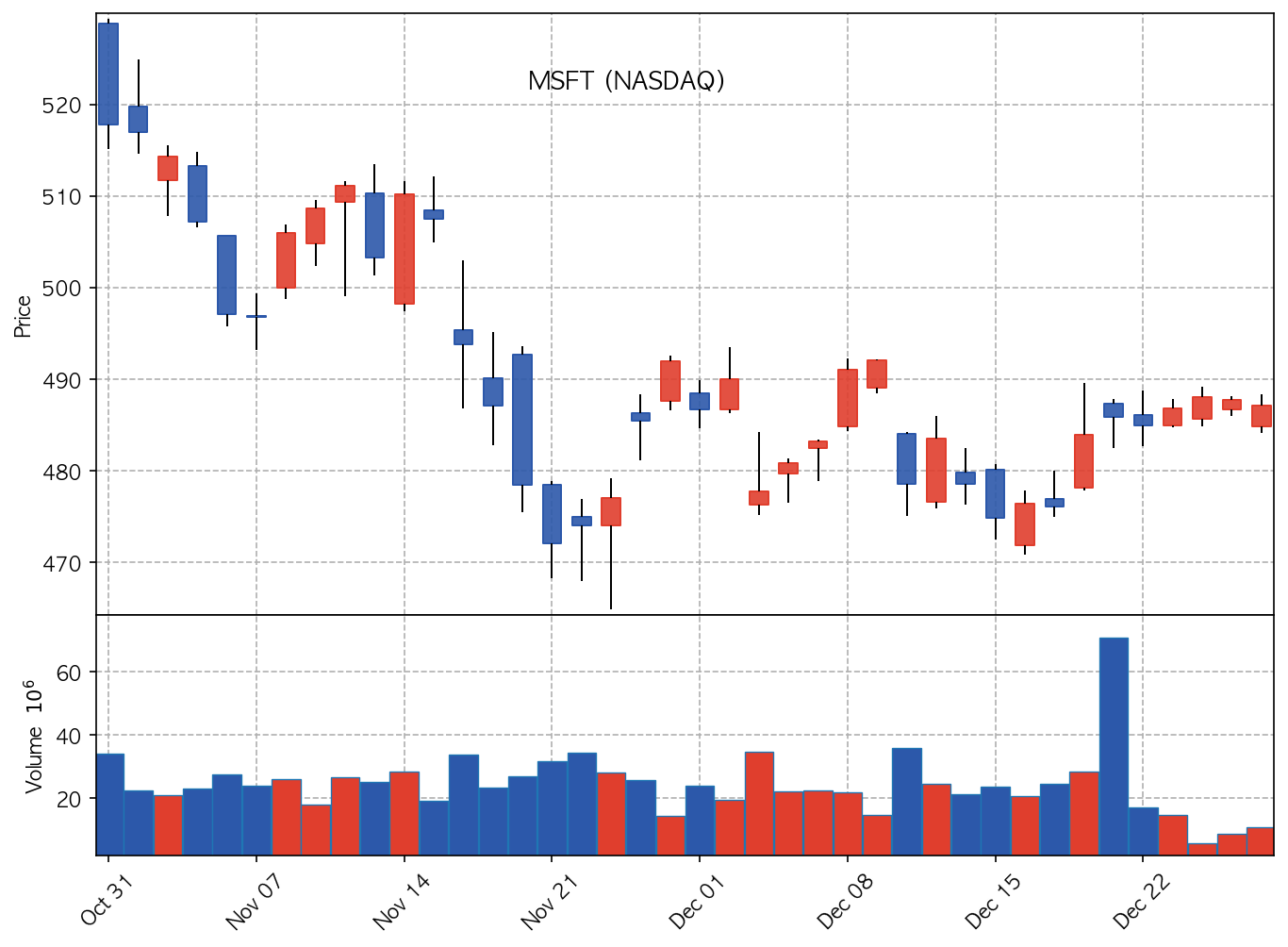

Technical Analysis: Key support levels are now in play. Watch for a bounce (or break) around $475. A sustained break below that could trigger a further cascade down to $450, and then the dreaded $420 level that hasn’t been seen since the start of 2025. On the upside, immediate resistance sits at $495 and then $510. The 50-day moving average, currently around $505, will act as a significant psychological barrier. Failure to reclaim the 50-day MA quickly will reinforce the bearish sentiment.

The Verdict: Buckle up, folks. This isn’t your typical holiday downturn. While the long-term AI utility thesis remains intact – Microsoft *is* the “architectural foundation of the AI era” – the immediate future is murky. We’re downgrading MSFT to a HOLD with a cautious eye. The next two weeks are CRITICAL. Monitor the Fed minutes and Q4 earnings closely. If Microsoft can demonstrate tangible AI revenue and manage expectations around capital expenditure, a recovery is possible. However, if the market continues to punish growth stocks and AI anxieties persist, prepare for further downside. This is a make-or-break moment for Microsoft. Trade accordingly!

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.