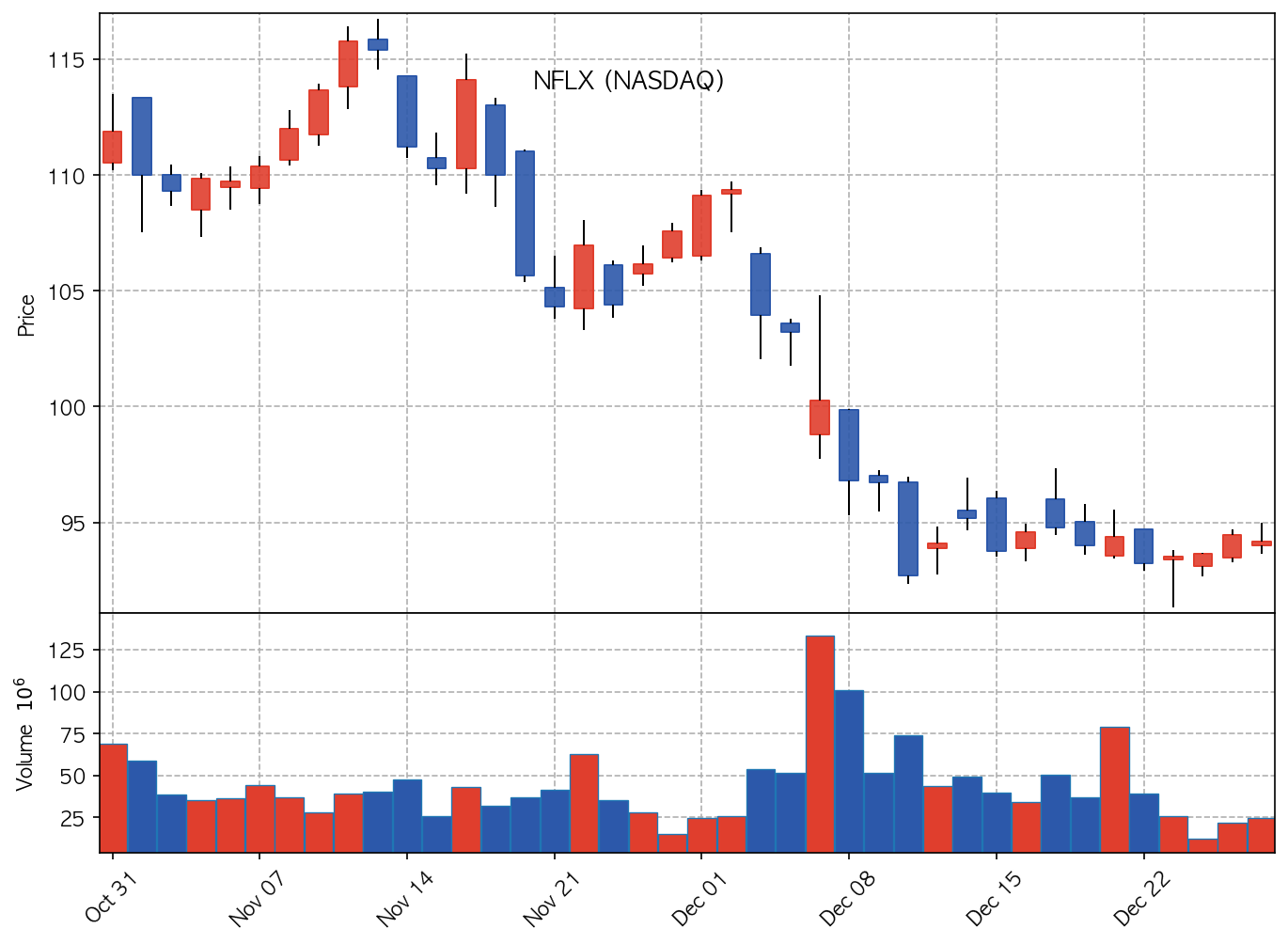

📉 NFLX Technical Analysis

Netflix: From Streaming King to M&A Pawn? A Value Trap or Once-in-a-Decade Buying Opportunity?

Netflix, once the undisputed ruler of streaming, is getting hammered. Down nearly 34% at $94.15, the question on everyone’s lips isn’t about subscriber growth, but survival. Is this the beginning of the end, or a blood-in-the-streets moment to back up the truck? Let’s dive in.

Market Context: A Perfect Storm of Uncertainty

The market is reeling from whispers of a Warner Bros. Discovery takeover, scrutiny surrounding potential regulatory hurdles and deal financing, and the overall cooling of the tech sector into year-end. Adding fuel to the fire are lingering questions about the ad-tier’s true momentum and Wall Street’s increasingly divided opinions. Whales are reportedly making moves (Benzinga), further muddying the waters. Is Netflix a quality stock to buy before 2026, as Yahoo Finance suggests? Or are the risks too high? The narrative is shifting rapidly, fueled by headlines and speculation, creating extreme volatility.

Technical Analysis: Key Levels to Watch

The current price of $94.15 is critical. A sustained break below $90 would signal further downside, potentially testing the COVID-era lows around $70-$75. On the upside, $100 is immediate resistance, followed by the 50-day moving average, currently hovering around $110. A successful breach of these levels would suggest a potential trend reversal, but requires strong catalysts, not just hope. Keep an eye on volume; significant buying pressure on upward moves would be a bullish sign.

The Verdict: Cautious Optimism with a HUGE Caveat

Netflix is undeniably interesting at these levels. The Warner Bros. Discovery deal, while fraught with risks, could unlock significant value. The ad-tier, if it gains traction, could provide a much-needed revenue boost. However, the regulatory uncertainty and financing concerns are real. Therefore, I’m issuing a cautiously optimistic rating: HOLD with a strong buy-the-dip mentality *IF* the Warner Bros. Discovery deal shows signs of progress. This is not a set-it-and-forget-it stock. Constant vigilance and a high tolerance for volatility are required. This could be the steal of the decade, OR a value trap waiting to explode. Tread carefully, my friends.

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.