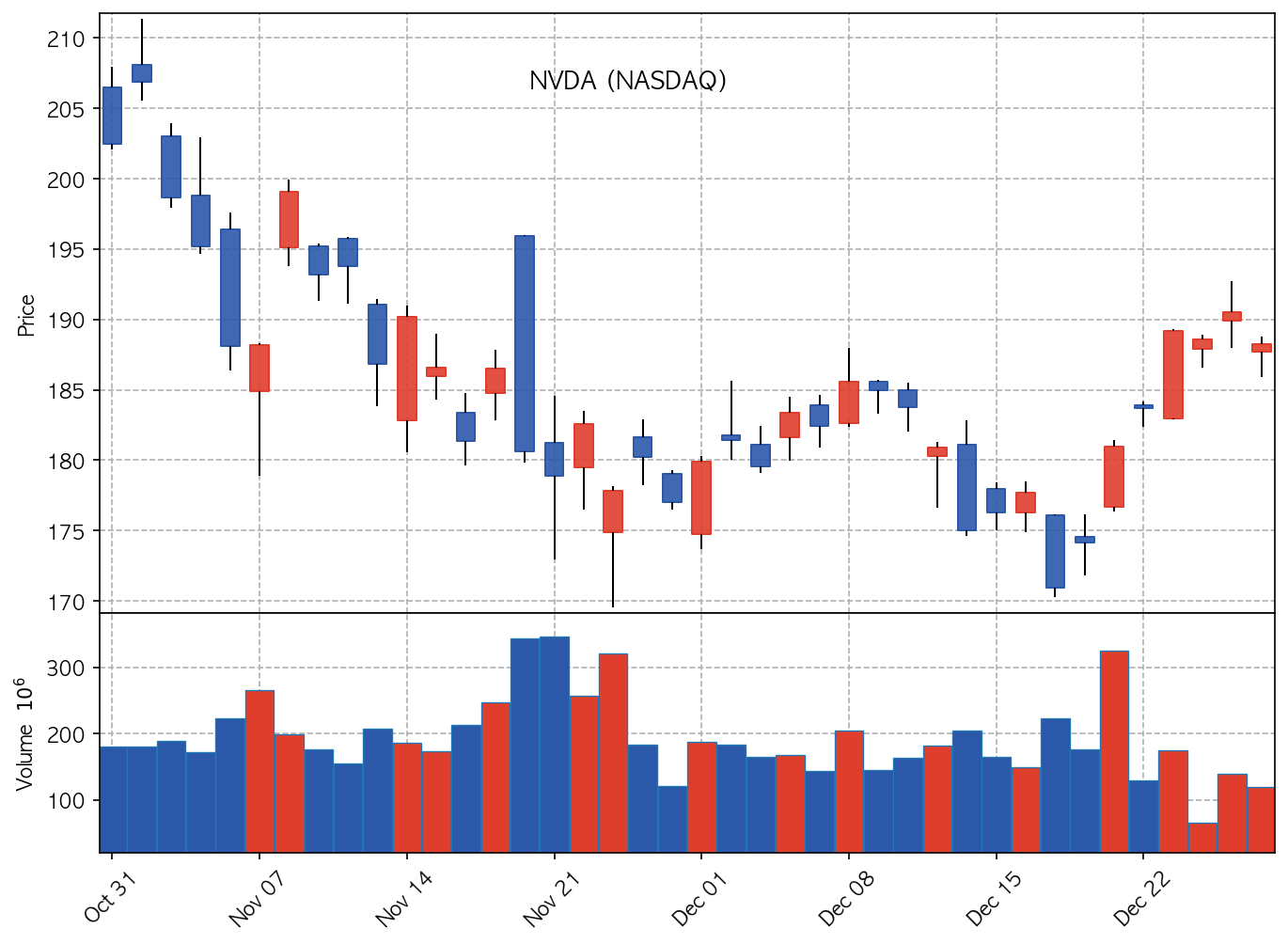

📉 NVDA Technical Chart

Subheadline:

After a rocky end to 2025, is Nvidia’s dominance truly threatened, or is this just another buying opportunity for the ages?

The Lede:

Listen up, folks! We’re staring down the barrel of 2026, and Nvidia (NVDA) is flashing amber. After a year of monumental gains, the stock’s recent wobble has the talking heads whispering “correction.” But I’m here to tell you – forget the noise. Let’s cut through the fluff and get to the hard truth: Is this the dip you’ve been waiting for, or is it time to bail before the ship sinks? I’ve spent 30+ years navigating these treacherous waters, and I’m not about to let you get caught in the undertow.

Market Context:

The current volatility stems from a perfect storm. AMD is breathing down Nvidia’s neck with rumored 2026 GPU price cuts, sending shivers down Wall Street’s spine. A “quiet performer” stock is supposedly doing better, causing unnecessary comparison. The Groq AI inference deal and Nvidia’s $20 Billion entry into AI inference are generating hype but also create uncertainty. The news of Nvidia taking a 4% stake in Intel with a $5 billion buyout also injects some ambiguity into the dynamics. This also occurs while people await CES 2026, with investors are wondering if NVDA is a Buy or Sell.

Technical Analysis:

Currently trading at $188.22 (-1.21%), Nvidia is testing a critical support level. We need to see a strong bounce here to confirm that the bulls are still in charge. Key resistance lies around $200. A break below $180 could signal further downside. Monitor volume closely – a spike in selling pressure would be a MAJOR RED FLAG.

Here’s the crucial data:

| Metric | Value |

|---|---|

| Price | $188.22 |

| 52W Range | $120 – $225 |

| Market Cap | ~$4.6 Trillion (Estimate) |

| Analyst Rating | Strong Buy (Consensus, but wavering) |

The Verdict:

Here’s the truth, unfiltered: I’m maintaining a BUY rating on NVDA, but with a very tight leash. The underlying demand for AI chips remains insatiable. Nvidia’s reorganization of its cloud division is a smart strategic move. Jim Cramer’s comments on NVDA’s IP reflect a confidence in NVDA’s assets. And the whispers of a price war from AMD? Consider that a buying opportunity if Nvidia demonstrates resilience.

However, don’t be reckless. Size your position carefully, and set a stop-loss order below $180 to protect yourself from further downside. This isn’t a “set it and forget it” situation. Monitor the news flow, watch the technicals, and be ready to adapt. Nvidia’s still the king of AI, but even kings can be dethroned. So, stay vigilant, stay informed, and let’s make some alpha in 2026!

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.