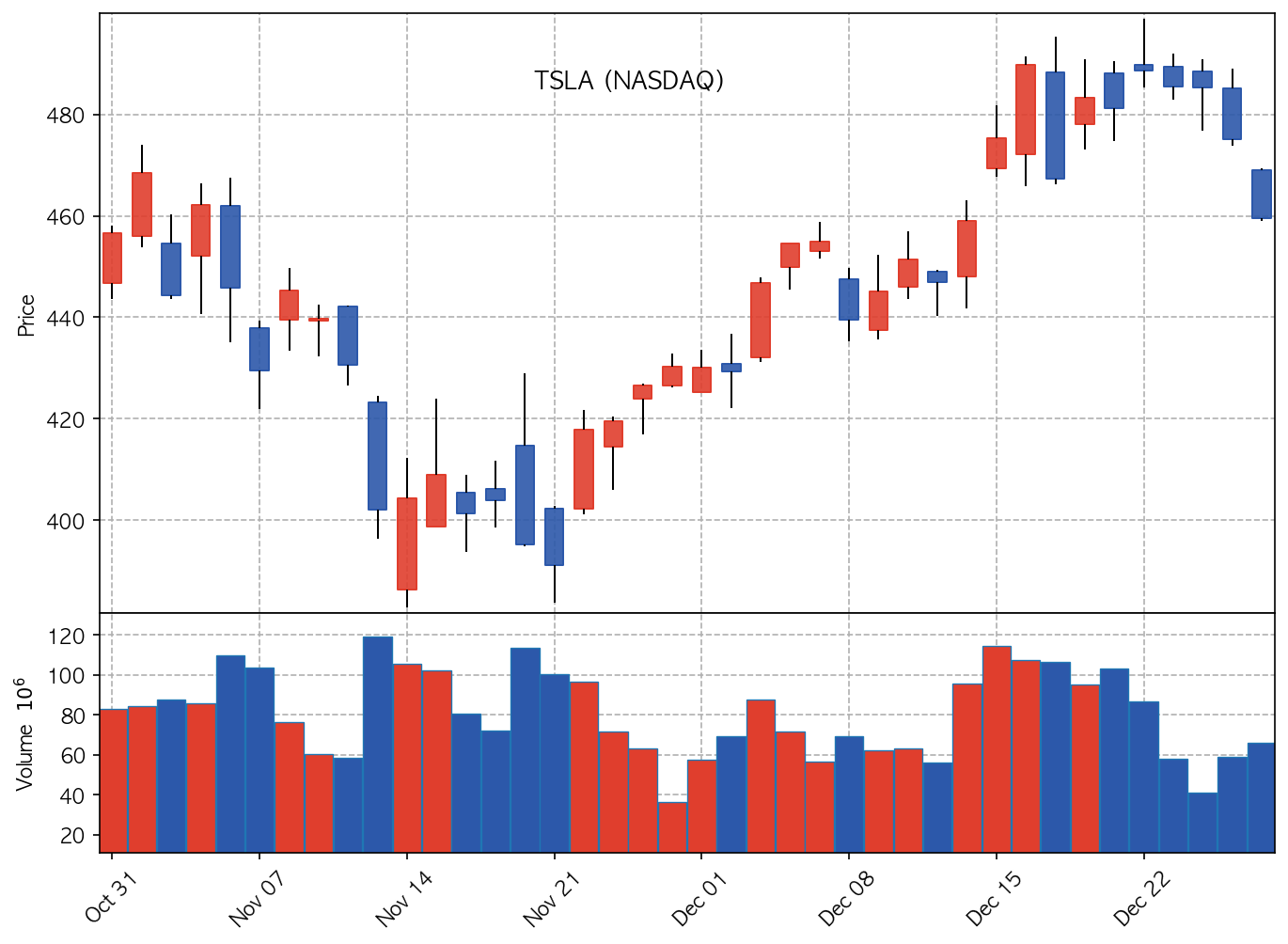

📉 TSLA Technical Chart

Subheadline:

Tesla’s robotaxi dreams are colliding with grim delivery numbers and a shifting market landscape, making this a crucial moment for investors.

The Lede:

Alright, listen up! The Kool-Aid days are OVER. We’re staring down the barrel of 2026, and Tesla, once the undisputed king, is wobbling. News of delivery contractions, slashed battery deals, and analyst downgrades are swirling like a toxic vortex. The question isn’t if Tesla is still a player, but if they’re playing the right game. We’re diving deep to separate the hype from the harsh reality. Buckle up, this ain’t for the faint of heart.

Market Context:

Let’s be brutally honest: The EV market is no longer a one-horse race. BYD is breathing down Tesla’s neck, traditional automakers are catching up, and the robotaxi initiative is a high-stakes gamble that could either revolutionize transportation or bankrupt the company. Add to that the negative news stream: Cathie Wood trimming her position (a canary in the coal mine?), a failed battery deal, and whispers of China imposing restrictions. This isn’t just a dip; it’s a potential tectonic shift. The market is reacting to these uncertainties, hence the drop in price.

Technical Analysis:

Tesla is testing a critical moving average, a point where it either bounces back with fury or plummets further into the abyss. Pay CLOSE attention to the $450 level. A sustained break below that could trigger a massive sell-off. The “Great De-Risking” is real, and Tesla is squarely in its crosshairs. Conversely, a strong bounce above $470 could signal a short-term recovery, but don’t be fooled; the underlying fundamentals need a serious gut check. Look at the RSI – is it oversold enough for a bounce? MACD is red, but is it about to cross over?

The Verdict:

Here’s the cold, hard truth: I’m slapping a HOLD rating on Tesla. Why not a sell? Because Elon Musk is still a wildcard. The robotaxi project COULD be a game-changer, but it’s a HUGE risk. The current price reflects the uncertainty, but not necessarily the underlying value of the company. This is a volatile stock, and timing is EVERYTHING.

THIS IS NOT A TIME TO BE A BLIND BULL OR A RAGING BEAR. WATCH, WAIT, and let the dust settle.

However, here is the information that you need to know:

- If you’re already holding, tighten your stop-loss orders.

- If you’re looking to buy, wait for a confirmed breakout above $480 or a significant drop below $430. Do not be a bagholder.

- Remember, this is a long game, and Tesla’s story is far from over. Do your own homework and don’t listen to the noise!

Key Data:

| Metric | Value |

|---|---|

| Price | $459.64 (-3.27%) |

| 52W Range | $357.52 – $488.40 |

| Market Cap | ~$1.4 Trillion |

| Analyst Rating | Mixed (leaning towards Sell) |

🔗 Investment Resources

Analyst Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Risk Warning: This article is for educational purposes. Trading financial instruments involves high risk.